Financial

Banking for Everyone

Easy Account Setup · No SSN Required · Free VISA ® Card

Metova Solution

LAUNCHED IN 2020

Promotes financial inclusion for unbanked

By providing an array of

financial solutions delivered via mobile devices, giving an overlooked audience a convenient, safe, and

cost-effective way of managing their finances.

MY BAMBU

Provides a series of strong financial tools

To serve individuals through debit cards, international money transfer, cross border payments, check deposits, and more, including immediate service available to those who need digital support.

IS HELPING

A new world of digital commerce

By being a complete online bank, with the backing and

partnership of FISGlobal, who have completed over 75 billion transactions globally.

A SCALE NEEDED

In-depth information on of the codebase

Build the remainder of the development work on

Android & iOS and prepare the banking application for a large consumer launch.

01

Research, Strategy &

Tech Assessment

Metova started reviewing the source code in the MyBambu mobile and web applications in May of 2019, and we found that the state of the source code did not align with the launch date that MyBambu was targeting.

Although the web portion of the code looked to be well-written and had tests in place appropriate for a quality product, the mobile codebases were in poor condition.

Metova produced a plan for remediation, identifying which issues were a priority to fix immediately, which issues could be fixed in the next few weeks, and which issues could be put off until after launch.

Metova has successfully been able to build out the features that MyBambu requested be in the application for launch and assisted through the development, design, distribution, and ultimate launch of the native MyBambu mobile application for iPhone and Android.

02

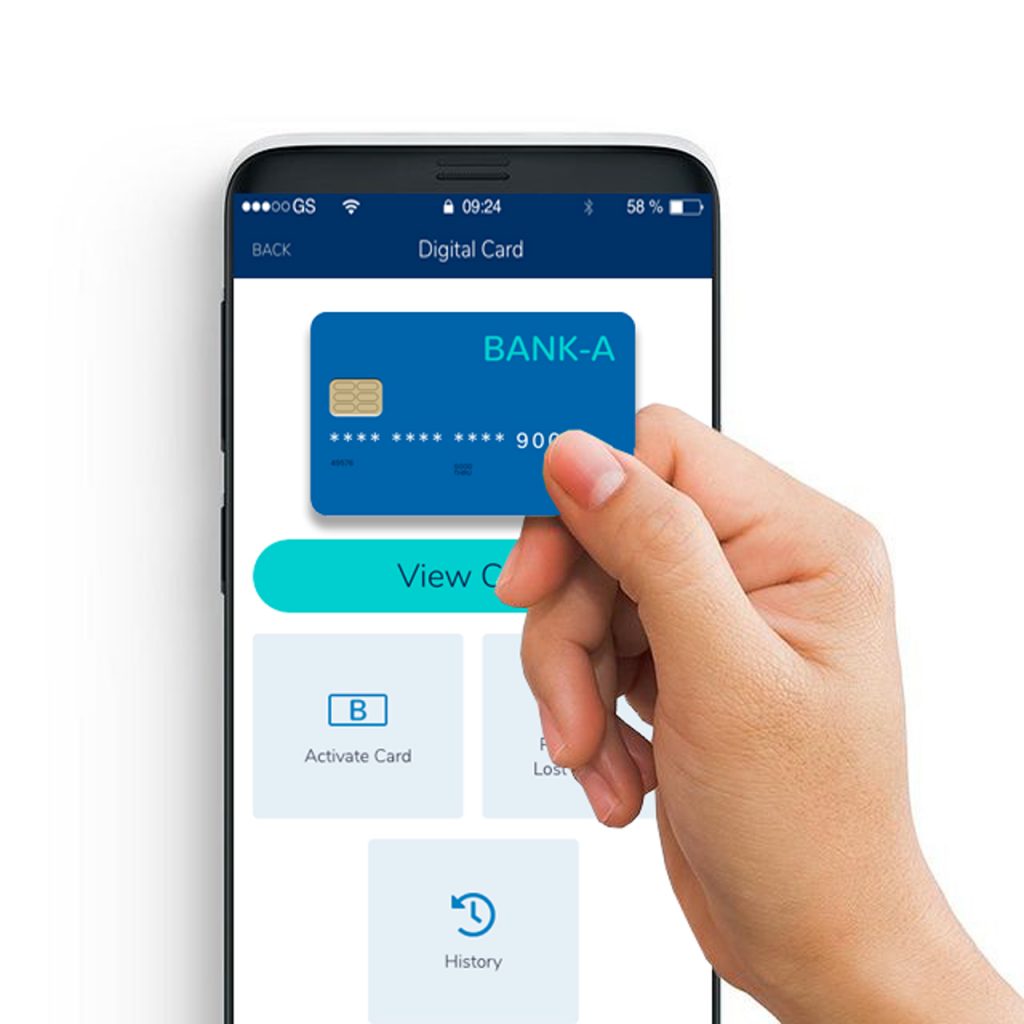

Design, primary and

secondary UX flows

There were many unique challenges to solve

When it came to design. Presenting a digital card through a mobile banking application required deep research on industry standards and competition in order to deliver an exceptional experience for users interacting with a digital bank.

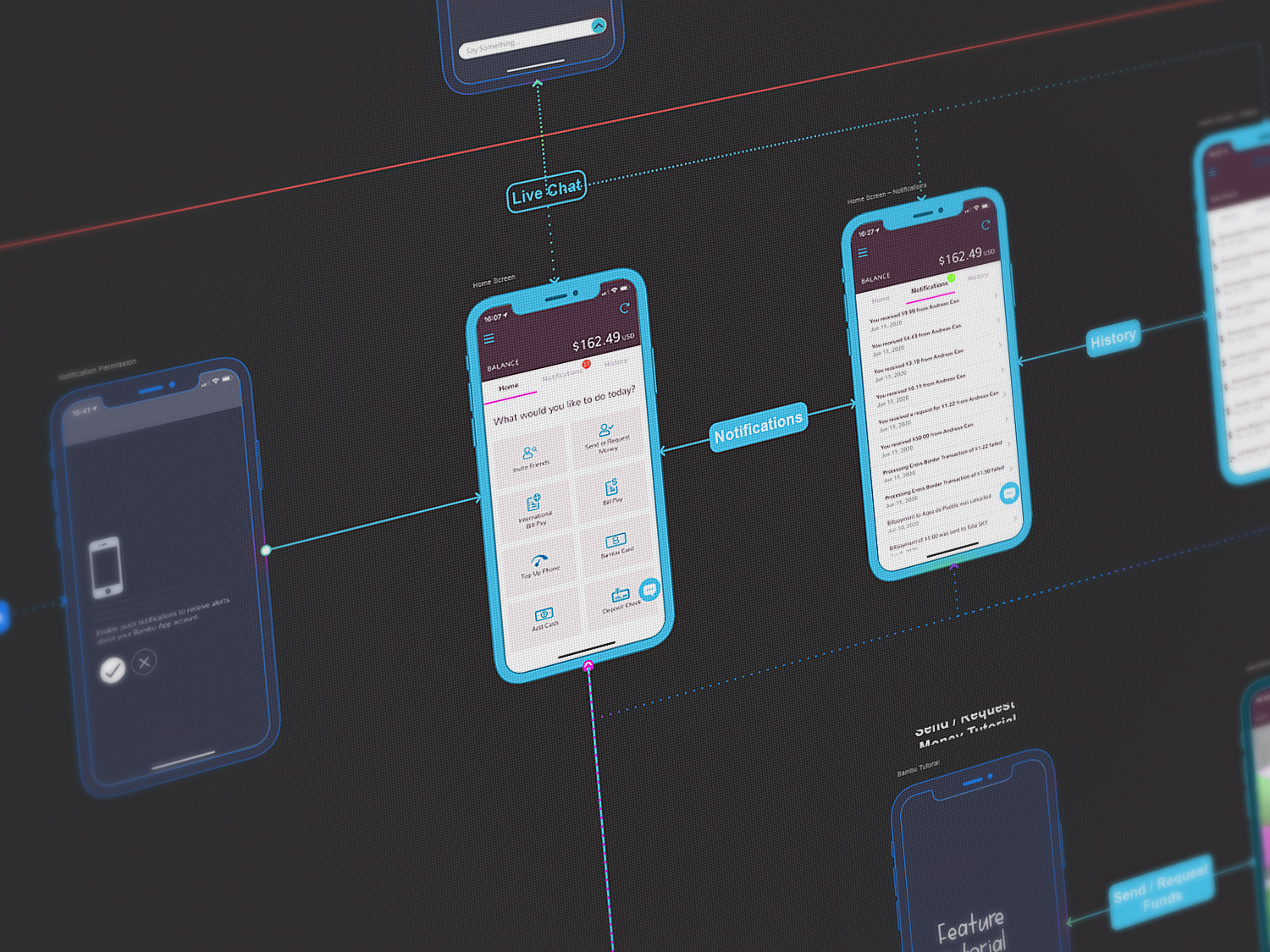

To accomplish this, Metova mapped out user action flows, primary and secondary UX flows, and content architecture diagrams as well as documents that drove the website and mobile application wireframes.

03

Development,

stories translated

into features

Metova and MyBambu worked closely together, to define business requirement documents which led to the creation of thoroughly written user stories.

Those stories translated into features that appeared on the mobile application and Metova’s quality assurance team stayed in sync with development to ensure that the quality of each feature was on par with the expected release and that no new regressions were introduced along the way.

Coordinating with multiple stakeholders was important as well to ensure that the designs, features, user experience and user interaction were all supporting the vision of a top tier banking application. Localization also played a dynamic factor in development as the mobile applications and website needed to be created for both Spanish and English speaking users.

Then used to help publish to the Apple and Google Play stores, along with a pre-registration feature to grow the user base before launch.

04

3rd Parties

& SDKs

In order to bring a transnational banking application to market, multiple vendors and Software Development Kits (SDKs) were needed to implement the multitude of features required from a security and functionality level for the mobile application.

Metova took the reigns in ensuring the technical team was familiar with each SDKs documentation, and furthermore directly collaborated with the leads of each SDK or 3rd-party representatives, to reduce friction and optimize the work-flow in a manner that would allow for each of the vendors and SDKs to be implemented in a timely manner.

A Complete Solution

Metova’s approach to helping our partners follows our core phases of engagement:

Development & Delivery

Research, Strategy & Tech Assessment

Quality

Approach & Challenge

let's talk

Got a project?

We’re a team of creatives who are excited about unique ideas and help fin-tech companies to create amazing identity by crafting top-notch UI/UX.